Blog

Comment: Results day was a defining moment in my career

Tom Llewelyn is Company Secretary and Head of Governance at The Cambridge Building Society. He recently completed The Chartered Governance Institute’s Qualifying Programme and in this comment piece, he shares his journey into the world of governance and why completing the QP was transformative for his career.

Blog

Formula One governance agreement 2026

Formula One’s 2026 Concorde Agreement has quietly reshaped the sport’s power structures by separating commercial terms from governance for the first time. The move reflects growing pressure on the FIA and F1 to demonstrate transparency, accountability and faster decision‑making.

Blog

Moving the goalposts? Governance lessons from football’s high-profile managerial exits

High profile exits at Manchester United and Chelsea have thrown football’s governance into sharp relief. Under intense financial and reputational pressure, unclear roles, blurred oversight and weak challenge mechanisms can destabilise clubs. A new regulator raises baseline standards, but only disciplined governance behaviour and culture can keep organisations resilient.

Blog

Can governance reform restore confidence in UK Universities?

UK universities face intense scrutiny and financial strain. This blog examines how governance reform, anchored in the forthcoming revision of the CUC Higher Education Code of Governance, can strengthen assurance, clarify roles and rebuild confidence across a diverse sector.

Blog

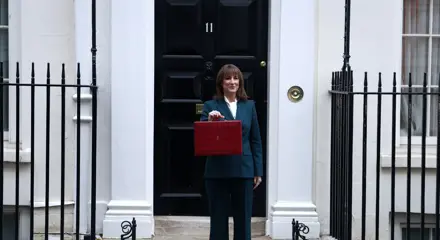

Budget 2025: Key considerations for governance professionals

Budget 2025 arrives at a moment of economic uncertainty and shifting expectations for public bodies and businesses alike. The Chancellor’s announcements will carry significant implications for governance, accountability and organisational resilience.